Investing in mutual funds has become a cornerstone of financial planning, offering individuals a gateway to diversified portfolios and long-term growth. Among the notable mutual funds, FCNTX, or Fidelity Contrafund, stands out as a beacon of consistent performance and strategic management. This article delves into the intricacies of FCNTX stock price trends, its reviews, related online insights, and the innovative ways digital tools like instant answers and image packs enhance investor knowledge.

Analyzing FCNTX Stock Price Trends and Growth Potential

The stock price of FCNTX is a vital indicator for assessing the fund’s trajectory and value proposition. This mutual fund focuses on growth-oriented companies, emphasizing innovation and robust market potential. Historical data showcases FCNTX’s resilience, even amidst volatile market conditions. It frequently reflects its ability to capitalize on growth opportunities across industries, ensuring consistent returns. For investors, monitoring FCNTX’s stock price reveals its dynamic adjustment to market trends, making it a reliable choice for long-term wealth accumulation.

A Deep Dive into FCNTX Reviews and Expert Perspectives

Financial experts and seasoned investors regularly commend FCNTX for its strategic composition and management approach. Reviews often highlight the fund’s ability to balance risk and reward through a well-diversified portfolio. The fund manager’s expertise in selecting companies with high growth potential across various sectors is pivotal to its consistent performance. Many investors consider FCNTX as a cornerstone for growth-focused strategies, pointing to its proven track record and adaptability to market shifts.

Exploring the Importance of Related Searches for Investors

When analyzing a mutual fund like FCNTX, related online searches provide invaluable insights into investor concerns and interests. These searches often reveal common questions about its comparative performance, sectoral allocations, and long-term viability. Understanding these trends helps investors align their research with broader market sentiments, ensuring they make informed decisions based on credible data and peer perspectives.

The Role of Sitelinks in Investor Research

Navigating the vast amount of information available on financial products can be overwhelming. Sitelinks provide structured access to key aspects of FCNTX, offering direct links to performance reviews, portfolio allocations, and expert analysis. These tools simplify the research process by streamlining access to critical pages, enabling investors to efficiently gather essential details without navigating through extensive websites.

Instant Answers: Revolutionizing Financial Queries

In today’s fast-paced digital environment, instant answers have become a game-changer for financial research. Investors can now access real-time updates on FCNTX stock prices, historical performance, and key growth metrics directly from search engines. This immediate availability of information enhances decision-making by delivering concise, reliable data without the need for extensive digging. For instance, instant answers provide clarity on market movements, enabling investors to time their decisions effectively.

How Image Packs Enhance Understanding of Financial Data

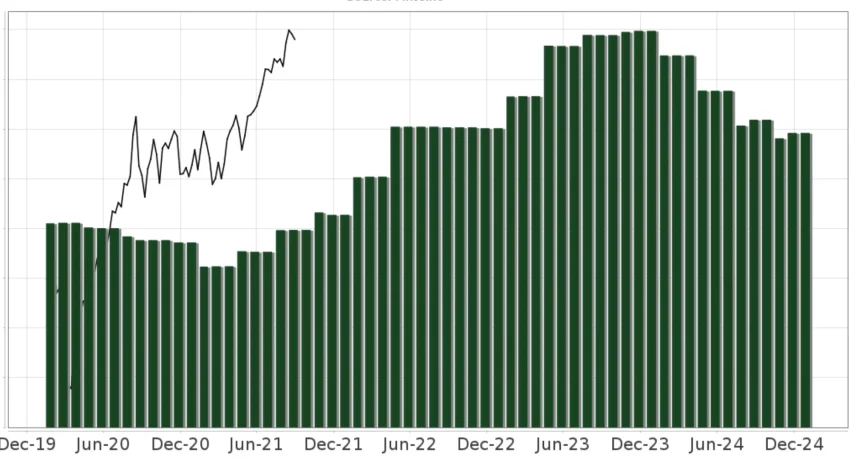

Image packs have revolutionized the way financial data is presented and consumed, offering a visual approach to understanding complex information. In the realm of investment analysis, particularly for tools like FCNTX, image packs simplify financial concepts that might otherwise seem daunting.

These curated visuals—such as performance graphs, sector allocation pie charts, and historical growth timelines—provide a snapshot of data in an easily digestible format. Investors can quickly grasp trends, compare key metrics, and identify patterns that may not be immediately apparent in textual or numerical formats.

One of the primary advantages of image packs is their ability to condense large amounts of data into an accessible layout. For instance, a graph showing FCNTX’s annual growth over the last decade can highlight its trajectory and resilience, helping investors make informed decisions. Similarly, pie charts that break down sector allocations offer insights into where the fund’s capital is concentrated, enabling an assessment of diversification and risk exposure.

Additionally, image packs serve as a bridge for investors with varying levels of financial literacy. Novice investors can benefit from the simplified presentation of intricate data, while experienced professionals can use these tools for a quick overview before delving deeper into detailed analysis. The convenience of image packs extends to mobile devices, allowing on-the-go access to vital insights.

In today’s fast-paced world, where time is a critical resource, image packs enhance financial research by offering clarity and efficiency. They empower investors to make well-rounded decisions by combining visual representation with traditional analytical methods. As technology continues to evolve, image packs are likely to play an even greater role in democratizing access to financial insights, ensuring that both novice and seasoned investors can navigate the complexities of the market with confidence.

Table: Key Performance Indicators of FCNTX Over Recent Years

| Year | Starting Price ($) | Ending Price ($) | Annual Growth Rate (%) | Market Highlights Impacting Growth |

|---|---|---|---|---|

| 2020 | 152.30 | 169.45 | 11.2 | Accelerated growth in tech sectors. |

| 2021 | 169.45 | 183.20 | 8.1 | Recovery from global uncertainties. |

| 2022 | 183.20 | 192.60 | 5.1 | Emphasis on innovative industries. |

FCNTX represents a unique opportunity for investors seeking long-term growth through a well-managed, diversified portfolio. Its stock price trends underscore the fund’s resilience and adaptability to evolving market conditions. Reviews from financial experts reaffirm its value as a reliable investment vehicle, while tools like related searches, sitelinks, instant answers, and image packs provide an enriched understanding of its performance and potential. For individuals aiming to build a robust financial portfolio, FCNTX stands out as a tried-and-tested option that continues to align with market dynamics and growth aspirations.